The Chain Reaction of Rising Prices of Magnesium Appears

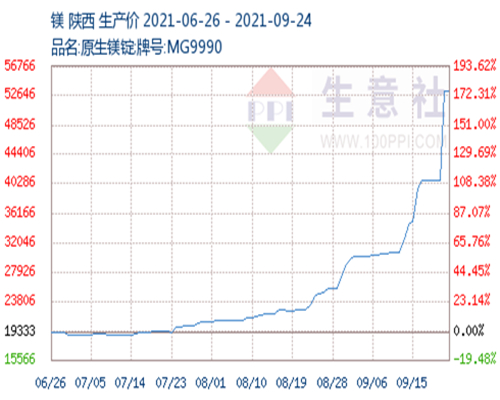

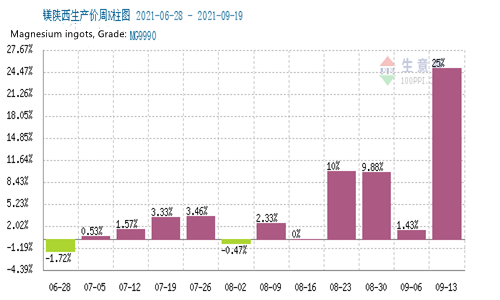

After the Mid-Autumn Festival, the magnesium market has once again become the focus of hot discussion. The price of magnesium ingots has soared from RMB¥45,000 per ton before the mid-autumn Festival to RMB¥70,000 per ton, the increase about more than 30% in a single day. This increase is jaw-dropping. The reporter learned from the Fugu area of Shaanxi Province, the country's largest magnesium industry agglomeration and price formation center, that the superposition of multiple factors such as soaring raw material prices and dual control of energy consumption have unbalanced the supply and demand of magnesium ingots, and prices have risen sharply. Both production companies, processing companies, and application companies have had varying degrees of impact.

The Price of Magnesium Ingots is “Rising”

Fugu County is the world's largest raw magnesium production agglomeration area. There are more than 35 raw magnesium production enterprises with a production capacity of more than 700,000 tons, accounting for more than half of the country's output. Reporters learned from the region that there are three main reasons for the increase in the price of magnesium ingots this time.

Firstly, there is a supply gap and price increase in the price of raw materials. Shaanxi metal magnesium is mostly used in the recycling industry of blue carbon, ferrosilicon and magnesium metal. The production of raw magnesium and coke powder (blue charcoal and clean charcoal) is greatly affected by the price of raw coal. Since this year, the price of ferrosilicon, the raw material for the production of magnesium ingots, has risen from RMB¥5,600/ton at the beginning of the year to RMB¥22,000/ton, and the price of coal has risen from RMB¥350/ton to RMB¥1,500/ton. The price of ferrosilicon and coal has repeatedly reached new record highs. The high production cost has brought considerable pressure to the production and operation of enterprises. For some time, coal has even been priced out of the market, making it extremely difficult to purchase. Some magnesium smelting companies have been forced to cut producing or even stop producing, which has led to higher costs and pushed magnesium prices higher.

Secondly, the decline in magnesium production capacity due to environmental factors. In 2019, Yulin City launched a three-year action plan for the upgrading and green development of the blue charcoal industry, which clearly stated that ecological and environmental protection should be used to force industrial transformation, optimize the layout of the blue charcoal industry, and promote large-scale agglomeration to achieve the overall requirements of high-quality development of blue charcoal production. According to the requirements of the National Development and Reform Commission's Industrial Guidance Catalogue, the blue carbon production plants with a single furnace capacity of less than 75,000 tons have been upgraded and transformed. Due to the intersection of the smelting and distribution section and the blue carbon production plants, various raw magnesium production enterprises have begun to upgrade their bids, increase capital investment, and increase production costs. The increase in production costs is one of the reasons for the increase in magnesium prices.

Thirdly, the dual control of energy consumption has increased. On September 13th, the Yulin Municipal Development and Reform Commission issued the "Notice on Ensuring the Completion of the 2021 Energy Consumption Dual-control Target Task", which requires that from September to the end of the year, some key energy-using enterprises will implement production restrictions, production shutdowns and other regulatory measures, involving more than 40 metal magnesium smelting enterprises. On September 20th, the first batch of energy consumption dual-control key control enterprises in Fugu County stopped production of power supply measures, including blue carbon and metal magnesium industry enterprises. The reporter learned that the shutdown and production restrictions have involved the Fugu County magnesium Plant, and the main magnesium plants in Fugu County have all been shut down in accordance with the requirements. Fugu County's magnesium production accounts for more than half of the country's total. The shutdown of production in this region is bound to affect the total domestic output, which is an important factor affecting the price of magnesium ingots.

The Chain Reaction of Rising Prices of Magnesium Appears

Most raw magnesium manufacturers have felt the strong increase in the price of magnesium ingots this year. “The company has been producing magnesium ingots for so many years, and this year is the highest price in history. ”A person from a magnesium factory in Fugu said that although the price has risen again, it is unprofitable at all. Under the influence of raw material prices, the cost of magnesium ingot production enterprises continues to increase. “This year's extremely high coal prices have driven up costs along the way. Facing the highest coal prices in history, we are helpless and can only passively accept the purchase of raw materials for magnesium refining. ”The person in charge of the company said that he did not make money last year and this year, and at the same time, he also paid a lot of environmental protection upgrade costs. What's more difficult is that under the influence of the dual-control policy on energy consumption, all factories in the Fugu area have been shut down since September 22. When reporters asked about the time to resume production, the company was also slightly confused.

Facing the trend of rising prices, the response measures taken by magnesium deep-processing enterprises in Hebi, Henan Province, are to suspend the shutdown of all enterprises to reduce operating risks. “As prices rise and costs increase, not only will we have no profits, but we will also have more serious losses. ”A magnesium deep-processing company said that most companies are in a wait-and-see state and have some concerns about rising prices.

The rapid rise in the price of magnesium ingots will also bring cost-raising pressure to related industries in the short term, especially exacerbating the operating difficulties of downstream small and micro enterprises.

For another large sponge #titanium# company that uses magnesium, the price of magnesium ingots has risen too fast, which is fatal. As of the press time, the price of magnesium ingots has reached RMB¥70,000/ton, while the price of titanium sponge has only reached RMB¥68,000/ton. Due to excessive cost growth, #titanium sponge# companies have suspended their quotations. “The full-process production of titanium sponge requires 10%-15% of magnesium ingots to supplement. Based on the current higher magnesium ingot price, the procurement cost has increased by about RMB¥10 million. “Sponge titanium production enterprises admit that the cost of semi-process production enterprises is even greater. It costs RMB¥70,000/ton to purchase only magnesium ingots, and the price of sponge titanium needs to reach RMB¥100,000/ton to avoid losses. For RMB¥100,000/ton of titanium sponge, it is not known whether downstream customers can accept it, and whether the order can be signed and sold normally.

The Problem Behind The Chain Reaction Deserves Attention

Insiders in the industry believe that the increase in the price of magnesium ingots has certain risks and shocks, which have caused a series of chain reactions. They hope that the price of magnesium ingots will run smoothly and develop healthily. The unusual price increase of magnesium ingots has also brought some problems worthy of attention.

The person in charge of the magnesium ingot manufacturer said that the prices of ferrosilicon and coal have a great impact on the price of magnesium. He hopes that the country will control the high energy consumption and deal with the relationship between capacity and supply and price stability while controlling the high energy consumption.

Downstream deep-processing companies said that in order to avoid being affected by price fluctuations during special periods, on the one hand, they must store magnesium ingots, buy them at low prices, and increase inventory; throw them out at high prices to balance prices. On the other hand, it is necessary to establish a trading market to balance the contradiction between supply and demand in the magnesium market, and to accelerate the development of the magnesium industry.

The high price of domestic magnesium ingots has also attracted the attention of the International Association of American States. Rick McQueary, Chairman of the International Magnesium Association, said in an open letter that the International Magnesium Association is very concerned about the short-term impact of capacity cuts and price increases on industry growth. Although the current situation is so tense, it still hopes and encourages magnesium users to continue to consider the application of magnesium materials from a long-term perspective. He believes that the magnesium market will gradually return to normal.

Although no one can accurately predict the price trend in the coming months, but looking back on history, it is found that the sharp changes in the price of magnesium ingots are always accompanied by price reductions and tend to calm down. “Magnesium prices may continue to rise in the coming months, but they will return to a more normal level by the end of the first half of 2022. ” This is what Rick McQueary hopes and what we in the magnesium industry are looking forward to.